Applying the McKinsey 7S Model to Enhance Credit Union Success

The McKinsey 7S was introduced in Tom Peters and Robert Waterman’s book, In Search of Excellence, in the late 70s. The 7S framework changed how leaders viewed organizational effectiveness. Before 7S, executives focused on organization structure, who does what, who reports to whom, and the relative authorities of each tier on the org chart. As organizations grew more complex, the challenge became coordination; how can the silos operate collaboratively. The Model 7S framework looks at organizations as an organism of interrelated elements that affect the organization’s ability to change, not as a hierarchy. This lack of hierarchy recognizes that success in one silo will be difficult without coordinating and collaborating with the other silos; that every strategic objective is cross-silo and cross-functional. Today, 7S remains a relevant methodology for understanding complex organizations and realizing structure alone isn’t an organization.

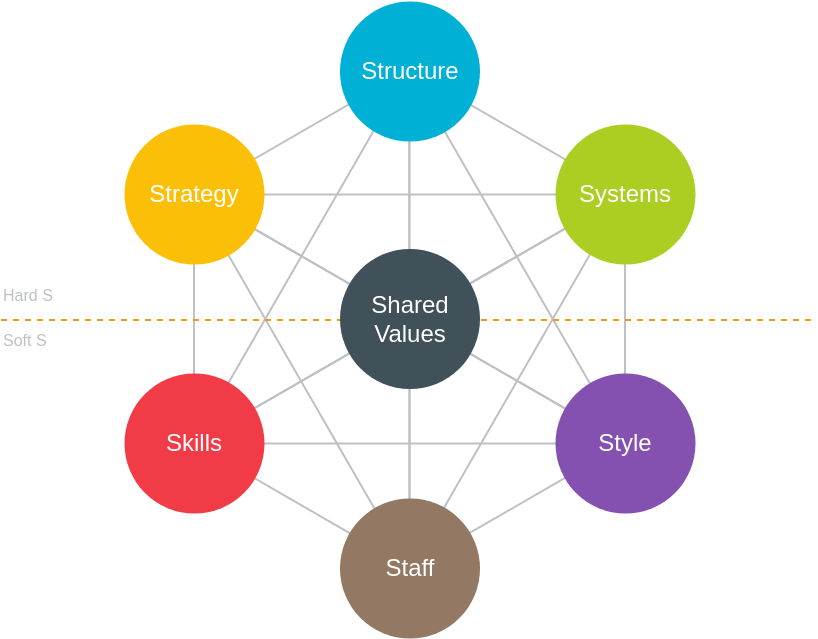

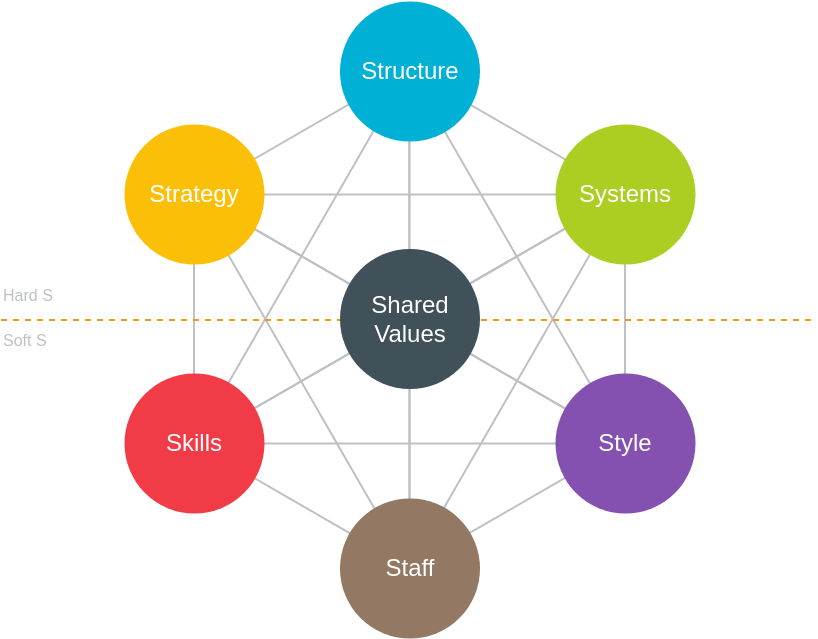

It is no secret that credit unions must manage multiple silos of their operation, and the McKinsey 7S Model is a management framework that will help leadership identify, understand, and address key elements that collectively determine the effectiveness and, ultimately, the success of their organization. These seven elements are divided into two categories: hard elements and soft elements. Below, I will explore how credit unions can apply the McKinsey 7S Model to enhance their operations, foster growth, and better serve their members and their chosen communities:

Hard Elements

- Strategy: The credit union’s plan for achieving its objectives, including market positioning, product and service offerings, and competitive advantage.

- Structure: The organization’s formal framework, including the hierarchy, reporting relationships, and operational processes.

- Systems: The technology and procedures in place to support day-to-day operations, such as information systems, payment processing, risk management, and data management and governance.

Soft Elements

- Shared Values: The credit union’s core beliefs, mission, and culture guide its actions and decision-making.

- Skills: The competencies and abilities of the employees, including their technical and interpersonal skills.

- Staff: The organization’s workforce, including its size, composition, and distribution of talent.

- Style: The leadership and management approach employed by the credit union’s leadership.

For this discussion, I will refer to “STELLAR” Credit Union as a theoretical case study on how the 7S Model can be applied. “STELLAR” is a mid-sized credit union operating in a competitive market. To navigate the disruptive and evolving landscape and to better serve its members. It demonstrates how “STELLAR” Credit Union implemented the 7S Model to achieve organizational excellence, deliver superior member service, and improve employee satisfaction.

- Strategy: Credit unions should start by assessing and refining their strategic plans to align with the changing financial services landscape. “STELLAR” recognized the importance of having a clear and adaptable strategy to remain competitive. They analyzed their market position, member needs, staff needs, and emerging financial trends. By aligning its strategy with these findings, “STELLAR” aimed to distinguish itself as a member-focused institution offering innovative financial products and services and to discover ways it needs to change to serve its stakeholders better.

- Structure: Credit unions should review their organizational structure to ensure it supports the strategic objectives. This may involve adjusting reporting lines, clarifying roles and responsibilities, or adopting a more agile structure that can adapt to evolving member needs. “STELLAR” implemented a more agile and member-centric framework to ensure its organizational structure supported its strategy. They flattened hierarchies, enabling faster decision-making and improved communication. The new structure encouraged cross-functional collaboration and responsiveness to changing member, environmental, and competitive demands.

- Systems: Recognizing the importance of technology in delivering seamless, easy-to-use, and faster member experiences, “STELLAR” made substantial investments in upgrading its information systems. They implemented a state-of-the-art online and mobile banking platform, loan origination systems, enhanced cybersecurity measures, and improved data analytics capabilities to gain insights into member behavior and preferences.

- Shared Values: Cultivating a member-centric culture that places the members’ interests at the forefront is the desired outcome. This is done by maintaining transparency, ethical standards, and a commitment to financial education. “STELLAR” embraced this culture of transparency, integrity, and a commitment to financial education. Members’ interests were placed at the core of every decision. These values were emphasized and managed throughout the organization. Staff were encouraged and coached to embrace and integrate these shared values into their daily interactions with members, each other, and the community.

- Skills: Recognizing the investment in training and development programs to improve employees’ skills and adapt to changing industry trends is essential, including financial literacy training and ongoing development of technical and soft skills, “STELLAR” introduced ongoing training programs to enhance these skills for employees to keep them competitive. They provided financial literacy, technical, and soft skills training for employees and encouraged them to Practice effective communication and empathy when interacting with members, each other, and the community.

- Staff: “STELLAR” needed to consider the size and composition of the workforce and ensure that it aligned with the credit union’s strategic objectives. Also, it needed to implement talent management strategies to attract, retain, and develop top-tier employees and enhance employee loyalty and engagement. As a result of this knowledge, “STELLAR” closely reviewed its workforce composition and found that it needed to attract and retain top-tier talent to support its strategy. They introduced innovative talent management strategies, such as competitive compensation packages and opportunities for professional growth, to ensure a skilled and motivated workforce.

- Style: Since effective leadership requires consistency to foster a culture of collaboration and shared values, the leadership team at “STELLAR” adopted an open and collaborative leadership style. They encouraged innovation, risk-taking, and continuous improvement. The leadership style was characterized by regular communication with employees, plus a discipline of regular one-to-one meetings and team huddles and an unwavering commitment to the credit union’s mission of serving members.

The credit union’s application of the 7S Model resulted in several benefits:

- Improved Member Service: Members noticed a positive change in the credit union’s service quality, with quicker response times, innovative products, and a more personalized approach. Improved Member Service: Aligning the model elements ensures that the credit union is better equipped to meet the needs of its members, enhancing their overall experience.

- Improved Employee Engagement and Satisfaction: Employees became more engaged as they realized the credit union invested in their skills, professionalism, and careers. Coupled with the values of transparency, integrity, and financial education, their loyalty also peaked. The financial education’s unexpected benefit for the credit union was that employees improved their family money management, creating a healthier and more present staff.

- Enhanced Efficiency: Through streamlined and aligned operations, systems, and processes across silos and adopting agile structures, the credit union improved its efficiency, reduced operational costs, and made the member experience faster, easier to use, and more streamlined.

- Competitive Advantage: Because it developed a clear and effective strategy, supported by the proper structure, systems, and skilled staff, “STELLAR” successfully positioned itself as a leading financial institution in its market, attracting new members while improving member and staff retention.

- Sustainability fostered a solid organizational culture and commitment to shared values, leading to long-term stability and resilience in an ever-changing market. It allows “STELLAR” to weather market fluctuations and remain stable and resilient in a competitive and disrupted market.

Our faux Credit Union’s successful application of the McKinsey 7S Model exemplifies how this management framework can drive organizational excellence. The credit union improved its operations by focusing on the 7Ss: strategy, structure, systems, shared values, skills, staff, and style. It secured its position as a leading financial services provider, committed to delivering exceptional value to its stakeholders.