Posts Tagged ‘culture’

Mitigating the Risks of Open Banking

Part 2 Navy Federal Credit Union (NFCU) recently faced a lawsuit centered on using artificial intelligence (AI) in its customer service operations. The lawsuit highlighted several critical issues, including data privacy, algorithmic bias, and transparency. This incident underscores the broader risks associated with adopting advanced technologies, such as AI, within the framework of open banking.…

Read More“Service as an Act of Stewardship” will Transform your Credit Union

Service, what is it? Bank service has been defined by the consumer as, did they engage me quickly, did they make eye contact, did they smile, were they fast, did they say thank you – a very low bar to member satisfaction but one that doesn’t differentiate the credit union. What can a credit union…

Read MoreServing Members as an Act of Stewardship

Several years ago, I worked with Dale Turner, now CEO at TruStone Financial Credit Union. As the VP of Lending, he stood at the podium of an all-staff meeting and challenged the entire credit union to “think for the member, don’t just respond to the member.” Dale had the wisdom to know the difference between…

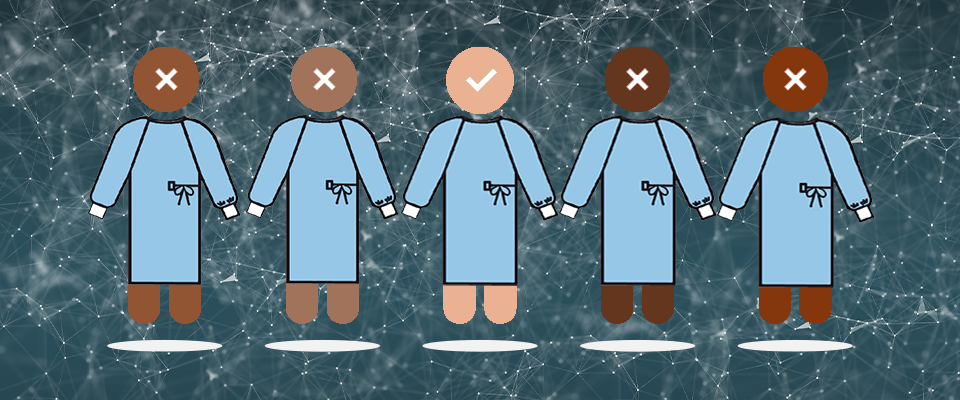

Read MoreLeaders, Avoid “Bobbleheads”

In leadership, the tendency to surround oneself with individuals who constantly nod in agreement—often called ‘bobbleheads’ due to their constant nodding—can be detrimental to effective decision-making, innovation, and overall credit union success. This behavior can lead to a lack of critical evaluation of ideas, as everyone agrees without questioning or offering alternative viewpoints. While it…

Read MoreIs Your Org Structure Top-Heavy?

First, let’s understand the impact of a top-heavy organizational structure on a credit union’s effectiveness, efficiency, and overall performance, which is critical. Here are the risks a top-heavy organization poses: Addressing a top-heavy organizational structure can be a significant challenge for a new CEO. Still, there are several practical steps to streamlining the organization and creating…

Read MoreThe Friction Paradox – Compliance vs User Experience

Friction /?frikSH?n/ noun – Any unnecessary obstacles users encounter while interacting with banking products or services. These manifest in various forms, including cumbersome account opening procedures, complex loan applications, processes that are not aligned or consistent from channel to channel, or outdated digital interfaces. While some friction is essential for security and regulatory compliance, excessive…

Read MoreMarketing Must Be Seen!

Marketing is not just an expense line; it is a strategic partner as credit unions face challenges adapting to rapidly evolving consumer preferences and technological advancements. By reimagining marketing’s place and purpose, credit unions can attract new members and reshape perceptions among their executives. First, let’s identify what marketing can and cannot control. What marketing…

Read MoreThe Empathic Leader: Investing in People Through Active Listening

Investing in people has taken center stage in the ever-evolving business and leadership landscape. As organizations recognize the importance of their most valuable and expensive asset – their employees – the focus has shifted towards fostering a workplace culture prioritizing empathy and active listening. Leaders who prioritize their teams foster a culture of belonging where…

Read MoreYou Are a New Executive in a Credit Union, Onboard Yourself First!

Joining a credit union as a CEO, EVP, SVP, or VP is exciting yet challenging. As an executive leader, your role is pivotal in driving the credit union’s strategies, mission, vision, values, growth, and member satisfaction. It is rare to find a credit union with a disciplined process to onboard executives, which, by the nature…

Read More