Blog

Open Banking – Securing Member Data

Part 5 CUToday’s June 26 newsletter: Truliant FCU Faces Proposed Class Action Lawsuit Over Data Breach: WINSTON-SALEM, N.C.–Truliant Federal Credit Union faces a proposed class action lawsuit after a data breach reportedly exposed the private information of more than 48,000 members… CUToday’s July 2 newsletter: ‘Serious Security Incident’ Leads to Major System Outage at Patelco…

A Future for Small Credit Unions

Part 4 – How Open Banking and Distributed Ledger Technology will help small credit unions compete. Open Banking and Distributed Ledger Technology (DLT) offer several advantages that can help smaller credit unions compete more effectively with larger financial institutions. Here’s how these technologies will be beneficial: Open Banking Benefits Distributed Ledger Technology (DLT) Benefits Combined…

Data Governance – Mitigating Data Biases

Part 3 Credit unions have many data sources beyond their core operating system. When a credit union conducts a data source inventory, it is not uncommon to have 50 or more data sources. These third-party data sets and reports commonly come in various formats, with different labels and definitions, and upload and report timing. Inconsistency…

Mitigating the Risks of Open Banking

Part 2 Navy Federal Credit Union (NFCU) recently faced a lawsuit centered on using artificial intelligence (AI) in its customer service operations. The lawsuit highlighted several critical issues, including data privacy, algorithmic bias, and transparency. This incident underscores the broader risks associated with adopting advanced technologies, such as AI, within the framework of open banking.…

Products and Services Likely to be Disrupted by Open Banking and DLT

Part One A headline in CUToday’s June 11 newsletter: “Headed to the U.S.? Stripe Intro’s Open-Banking-Powered Payments in the U.K.” This is one example of how Open Banking will revolutionize (disrupt) the financial services industry. Credit unions are not exempt from this disruptive wave. What is Open Banking? #Open Banking is a financial services innovation that…

“Service as an Act of Stewardship” will Transform your Credit Union

Service, what is it? Bank service has been defined by the consumer as, did they engage me quickly, did they make eye contact, did they smile, were they fast, did they say thank you – a very low bar to member satisfaction but one that doesn’t differentiate the credit union. What can a credit union…

Serving Members as an Act of Stewardship

Several years ago, I worked with Dale Turner, now CEO at TruStone Financial Credit Union. As the VP of Lending, he stood at the podium of an all-staff meeting and challenged the entire credit union to “think for the member, don’t just respond to the member.” Dale had the wisdom to know the difference between…

A CEO Problem – The Domino Effect of High Turnover at the Teller Line

Often, the only time the C-Suite becomes involved in recruiting is during the search for a strategic leader. This makes sense, but it is also vital that the C-Suite fully appreciate the impact of high turnover lower in the credit union’s hierarchy and approach these challenges strategically. This deeper dive is essential because high turnover,…

Leaders, Avoid “Bobbleheads”

In leadership, the tendency to surround oneself with individuals who constantly nod in agreement—often called ‘bobbleheads’ due to their constant nodding—can be detrimental to effective decision-making, innovation, and overall credit union success. This behavior can lead to a lack of critical evaluation of ideas, as everyone agrees without questioning or offering alternative viewpoints. While it…

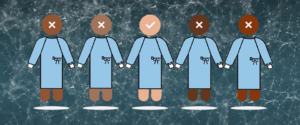

Is Your Org Structure Top-Heavy?

First, let’s understand the impact of a top-heavy organizational structure on a credit union’s effectiveness, efficiency, and overall performance, which is critical. Here are the risks a top-heavy organization poses: Addressing a top-heavy organizational structure can be a significant challenge for a new CEO. Still, there are several practical steps to streamlining the organization and creating…

Need help?

If you seek to align your culture to your mission, purpose, promise, and values, contact Rich at 720.256.4936 or Rich@l2ldev.flywheelsites.com.