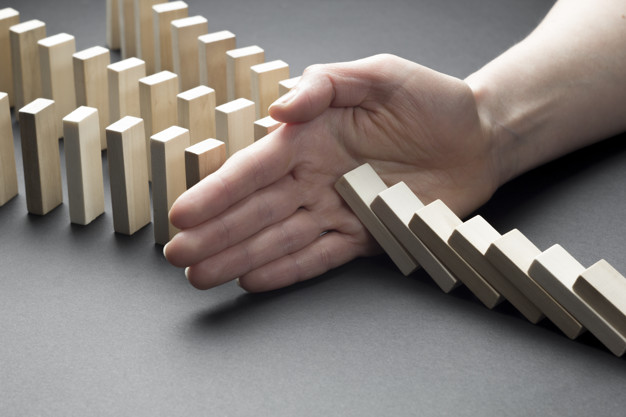

A CEO Problem – The Domino Effect of High Turnover at the Teller Line

Often, the only time the C-Suite becomes involved in recruiting is during the search for a strategic leader. This makes sense, but it is also vital that the C-Suite fully appreciate the impact of high turnover lower in the credit union’s hierarchy and approach these challenges strategically. This deeper dive is essential because high turnover, even at the entry-level positions, has a domino effect across the entire enterprise. Here are seven organizational impacts of high turnover:

- Disrupted Service Continuity: Tellers are the face of the credit union, often forming lasting relationships with customers. When turnover is high, these relationships become fragmented, leading to inconsistencies in service delivery. When members encounter new faces at every visit, the rapport and trust built over time are disrupted. Continuity is vital in fostering customer loyalty, and frequent turnover undermines this crucial element.

- Increased Training Costs: Constantly onboarding new tellers incurs significant training expenses. Each new hire requires time and resources, from teaching operational procedures to instilling the credit union’s values and service standards. High turnover amplifies these costs, diverting funds from other areas of the credit union’s operations, such as technology upgrades or community outreach programs.

- Diminished Employee Morale: High turnover breeds instability and insecurity among existing staff. When colleagues frequently depart, remaining employees may feel overburdened by the extra workload or demoralized by the lack of team cohesion. Low morale can lead to decreased productivity, absenteeism, and perpetuation of the turnover cycle as disillusioned employees seek greener pastures elsewhere.

- Impacts on Cross-Selling Opportunities: Tellers often serve as the first point of contact for customers interested in exploring additional products and services the credit union offers. However, with high turnover rates, tellers may lack product knowledge or rapport-building skills necessary to cross-sell effectively. This missed opportunity affects revenue generation and impedes the credit union’s ability to deepen relationships with its members.

- Reputation and Brand Perceptions: In an era where word-of-mouth and online reviews hold considerable sway, a revolving door of tellers can tarnish the credit union’s reputation. Consistently poor service due to high turnover may lead to negative reviews and erode the institution’s brand perception within the community. Rebuilding trust and credibility once lost can be daunting, potentially damaging the credit union’s market standing.

- Operational Efficiencies: High turnover necessitates constant recruitment efforts and disrupts operational workflows. Vacancies at the teller line may lead to longer wait times for customers, increased errors in transaction processing, and heightened stress levels among remaining staff. These inefficiencies impact customer satisfaction and strain internal processes, hindering the credit union’s ability to adapt and innovate.

- Financial Implications: Ultimately, the cumulative effects of high turnover at the teller line can manifest in tangible financial repercussions. Reduced customer retention, diminished cross-selling opportunities, and heightened operational costs all drain the credit union’s bottom line. Moreover, the indirect costs associated with reputational damage and reduced employee morale further exacerbate the financial strain.

High turnover, especially at the teller line, is not an isolated concern but a systemic issue with far-reaching implications for the entire credit union. Addressing this challenge requires a multifaceted approach, encompassing efforts to improve recruitment and retention strategies, enhance employee training and development programs, and foster a culture of employee engagement and empowerment. Many credit unions try to meet this recruiting demand internally, especially at the lower tiers of the hierarchy. This results in many managers’ and executives’ time reviewing applications and resumes, a costly recruiting model.

A more cost-effective method would be outsourcing all recruiting to the TQC Recruiting as a Service (RaaS) model. TQC has a wealth of recruiting experience using salaried (not commissioned) recruiters and a deep pool of prescreened applicants. Using the credit union’s screening parameters, TQC brings only those candidates who meet the credit union’s criteria to the hiring manager. With TQC’s RaaS Model, the credit union has unlimited recruiting access from entry-level to C-Suite hires without having to worry about the expense of paying per hire. This service will cost-effectively mitigate the adverse effects of high turnover and cultivate a thriving organizational ecosystem built on stability, service excellence, and enduring customer relationships.