Posts Tagged ‘strategic planning’

Best Practices for Achieving Strategic Alignment

A C-suite executive recently asked me, “One area where we have always struggled is with executives building their comprehensive plans. Have you seen that as a struggle elsewhere, and do you have any suggestions on addressing this? Strategic alignment and coordination are vital in attaining strategic success. Strategic alignment ensures that all aspects of a…

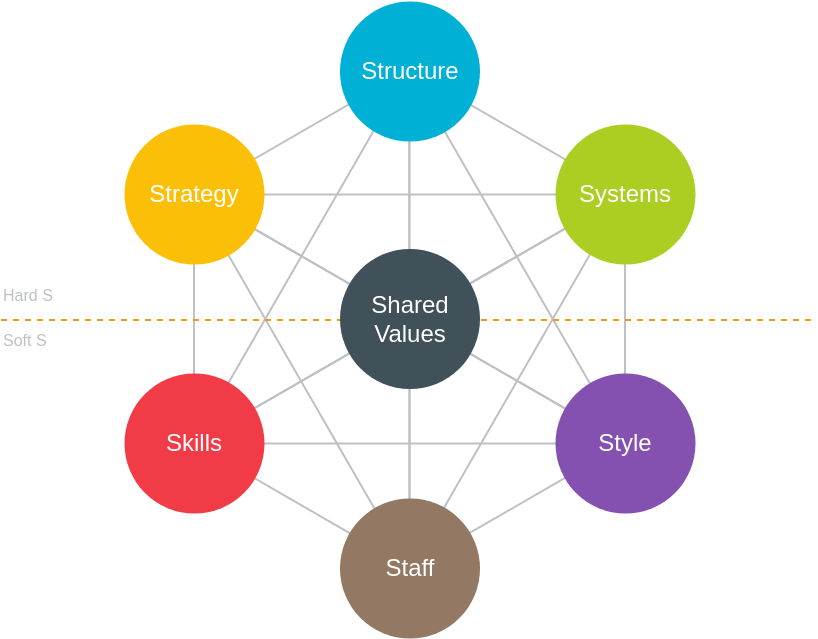

Read MoreApplying the McKinsey 7S Model to Enhance Credit Union Success

The McKinsey 7S was introduced in Tom Peters and Robert Waterman’s book, In Search of Excellence, in the late 70s. The 7S framework changed how leaders viewed organizational effectiveness. Before 7S, executives focused on organization structure, who does what, who reports to whom, and the relative authorities of each tier on the org chart. As organizations…

Read MoreMake your strategic planning process INCLUSIVE

Strategic planning is an essential part of any organization’s success. It helps businesses to define their goals, set priorities, and allocate resources effectively. In today’s diverse and rapidly evolving work environment, it’s more important than ever to prioritize inclusivity in all aspects of business planning, especially strategic planning. Being more inclusive in strategic planning will…

Read MoreStrategic Planning – Is there a right way?

Strategic planning isn’t: A box to check on your NCUA examination. A one or two-day brainstorming event To plan incremental growth without changing anything Done during budgeting time. Strategic planning should be started in Q1 or Q2 so that when the organization gets to budgeting time, the strategic objectives have been established, and the resource,…

Read MoreMoving From Incremental to Transformational Growth

Too often, I see organizations that keep getting in their way. They celebrate mediocre performance, average results, and incremental growth. Occasionally I find an organization that is satisfied in just cruising slowly into obsolescence, unwilling to admit what is happening to the company. Today’s competitive, fast-paced business climate does not tolerate mediocracy for long. Companies…

Read More5 Post-Covid Strategies

Everyone seems to be talking about the new normal, and I am not a fan of “new normal.” Normalcy has always been the siren’s call to irrelevancy and plateauing for credit unions. Here are the five things your credit union needs to consider as we move out of this pandemic: 1. Branches that don’t transition…

Read MoreThree Must Haves in your Strategic Plan

As you move into our strategic planning and budgeting cycles, there are three must-haves when crafting a prosperous future for your credit union: A Plan for Transformation: Strategic Plans should be designed to transform the organization. If the culture is, “If it ain’t broke, don’t fix it,” then don’t waste your time and money doing…

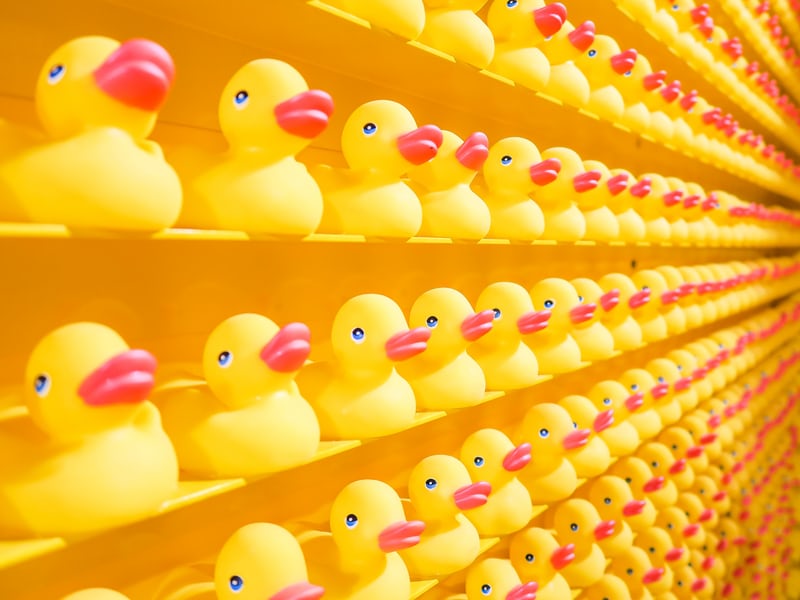

Read MoreGetting Your Ducks in a Row – Strategic Planning

We often think about strategic planning as a one or two-day event that involves some crucial steps: Validating your mission, vision, values Doing a SWOT (Strength, Weakness, Opportunities, Threats) analysis Thinking BIG about what you want to become Identifying 3-5 vital strategic initiatives that will take you to this future place These four steps are…

Read MoreWait, let’s not be emotionally driven – Really, NOW?!?

Why us it anytime something extraordinary happens, the “anti-change” elements of our organizations say, “Well now, we have to be careful, we don’t want to be driven by emotion?” Let talk. People who say, “let’s not be driven by emotion” are typically change-resistant. This “catchphrase” is a way to stop innovation and change conversation. They…

Read More