Posts Tagged ‘purpose’

Mitigating the Risks of Open Banking

Part 2 Navy Federal Credit Union (NFCU) recently faced a lawsuit centered on using artificial intelligence (AI) in its customer service operations. The lawsuit highlighted several critical issues, including data privacy, algorithmic bias, and transparency. This incident underscores the broader risks associated with adopting advanced technologies, such as AI, within the framework of open banking.…

Read More“Service as an Act of Stewardship” will Transform your Credit Union

Service, what is it? Bank service has been defined by the consumer as, did they engage me quickly, did they make eye contact, did they smile, were they fast, did they say thank you – a very low bar to member satisfaction but one that doesn’t differentiate the credit union. What can a credit union…

Read MoreServing Members as an Act of Stewardship

Several years ago, I worked with Dale Turner, now CEO at TruStone Financial Credit Union. As the VP of Lending, he stood at the podium of an all-staff meeting and challenged the entire credit union to “think for the member, don’t just respond to the member.” Dale had the wisdom to know the difference between…

Read MoreLeadership Brand – Supercharge Your Career

Have you ever defined your leadership brand? If you haven’t, now is the time. The process is simple but deliberate and does not happen overnight. It is a hero’s journey, so expect multiple opportunities to learn from your mistakes and to rely heavily on allies. Why is Your Brand Journey Important? It Enhances Your Credibility…

Read MoreFacing Career Disruption?

Career disruption creates anxiety. It presents itself in many forms: you feel your influence is waning, there is a potential for layoffs, the company’s performance is missing targets, or layoffs have been announced. These palatable disruptions often cause you to become fearful, more risk-averse, or even to try to become invisible. You should do the…

Read MoreMarketing Must Be Seen!

Marketing is not just an expense line; it is a strategic partner as credit unions face challenges adapting to rapidly evolving consumer preferences and technological advancements. By reimagining marketing’s place and purpose, credit unions can attract new members and reshape perceptions among their executives. First, let’s identify what marketing can and cannot control. What marketing…

Read MoreThe Empathic Leader: Investing in People Through Active Listening

Investing in people has taken center stage in the ever-evolving business and leadership landscape. As organizations recognize the importance of their most valuable and expensive asset – their employees – the focus has shifted towards fostering a workplace culture prioritizing empathy and active listening. Leaders who prioritize their teams foster a culture of belonging where…

Read MoreHow to Retain Employees and Members

Fostering a Culture of Belonging Employee burnout is a pervasive issue affecting organizations across various industries, and credit unions are no exception. The financial sector demands high commitment, attention to detail, and often long working hours, making credit union employees susceptible to burnout. However, creating a culture of belonging can be a powerful antidote to…

Read MoreManaging a Hybrid Workforce – Success Strategies

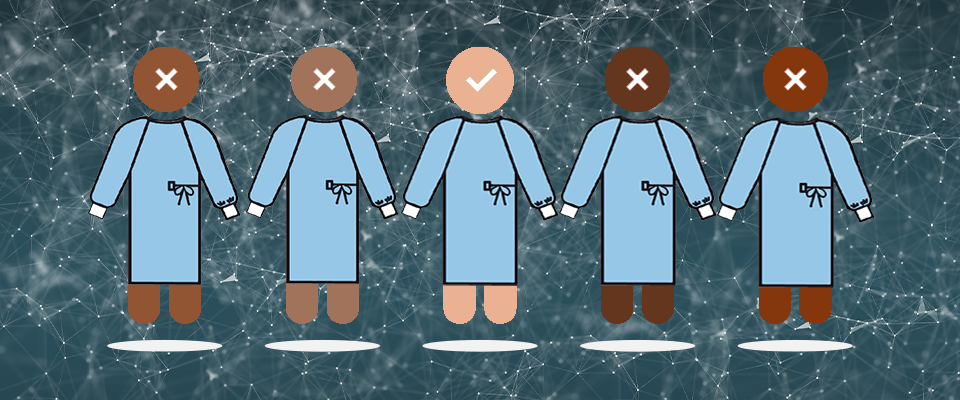

Managers are now challenged to effectively manage staff remotely. The cadence of when employees must be “in the office” versus working remotely varies from credit union to credit union and even department to department. Managers and policymakers must realize that team management focuses on equity versus equality. Let’s first identify the purpose of employees meeting…

Read More