Board of Directors

Best Practices for Achieving Strategic Alignment

A C-suite executive recently asked me, “One area where we have always struggled is with executives building their comprehensive plans. Have you seen that as a struggle elsewhere, and do you have any suggestions on addressing this? Strategic alignment and coordination are vital in attaining strategic success. Strategic alignment ensures that all aspects of a…

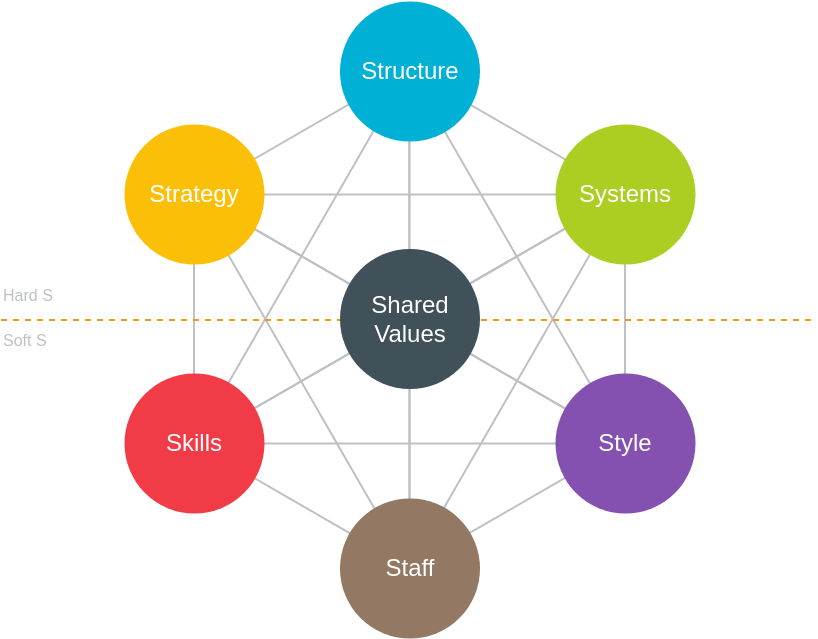

Read MoreApplying the McKinsey 7S Model to Enhance Credit Union Success

The McKinsey 7S was introduced in Tom Peters and Robert Waterman’s book, In Search of Excellence, in the late 70s. The 7S framework changed how leaders viewed organizational effectiveness. Before 7S, executives focused on organization structure, who does what, who reports to whom, and the relative authorities of each tier on the org chart. As organizations…

Read MoreAdapting “Management by Walking Around” for the Hybrid Credit Union

“Management by walking around” (MBWA) has been a management staple for decades. The phrase was popularized in the 1980s. Consultants Tom Peters and Robert Waterman explored the idea in their 1982 book, In Search of Excellence: Lessons from America’s Best-Run Companies. It involves leaders physically visiting their staff to observe their engagement and effort to understand…

Read MoreCrafting Leadership Excellence

The 12 Elements of a Successful Leadership Development Program for Credit Unions Credit unions operate in a highly volatile and competitive environment. Every major initiative requires cross-functional and cross-silo teams. Because of this ecosystem, credit unions must ensure consistent leadership behaviors and intentions for these diverse teams to be effective and execute expertly. Strong leadership…

Read MoreMedia-Driven Hysteria: The Relationship Between Home Buying Demand and Interest Rates

Buying a home is NOT just a transaction but a strategic goal for consumers. That strategic goal is to provide a home to raise a family, build on the promise of generational wealth, access better education for the member’s children, or provide recreational opportunities for the family. With the fundamental objective in mind, I’ll explore…

Read MoreDisrupting Strategic Planning

Strategic Planning 2.0 As we transition out of the strategic planning season, and after twenty years of being part of strategic planning on both sides of the table, I’ve observed the following process. The credit union identifies a strategic planning event on the calendar and often hires a strategic planning consultant to facilitate the meeting.…

Read MoreSituations a Credit Union Should Use a Fractional Executive

Credit unions often face unique challenges that require expert guidance. In many cases, hiring a full-time executive may not be feasible or necessary. This is where fractional executives come into play. A fractional executive is an experienced professional who provides their expertise part-time or temporarily. The following are situations in which a credit union should…

Read MoreWhat the Credit Union Board Should Know Before Hiring a Bank Executive

On the surface, the differences between running a bank and running a credit union seem very similar. However, for the Board of Directors to select the right executive to lead a credit union, it must consider that credit unions differ significantly from traditional banks’ structure, purpose, and values. The purpose of a credit union transcends…

Read MoreLeadership Requires INTENTIONAL Active Listening

Good News: Active Listening is a Learned Skill In a fast-paced and increasingly remote and digital world, communication has taken various forms, from texting and email to video calls and social media. With the rapid evolution of our work environment, communication needs to be seen in the prism of the art of active listening. We…

Read More