Embedded Finance

Taking banking to where your members live their lives.

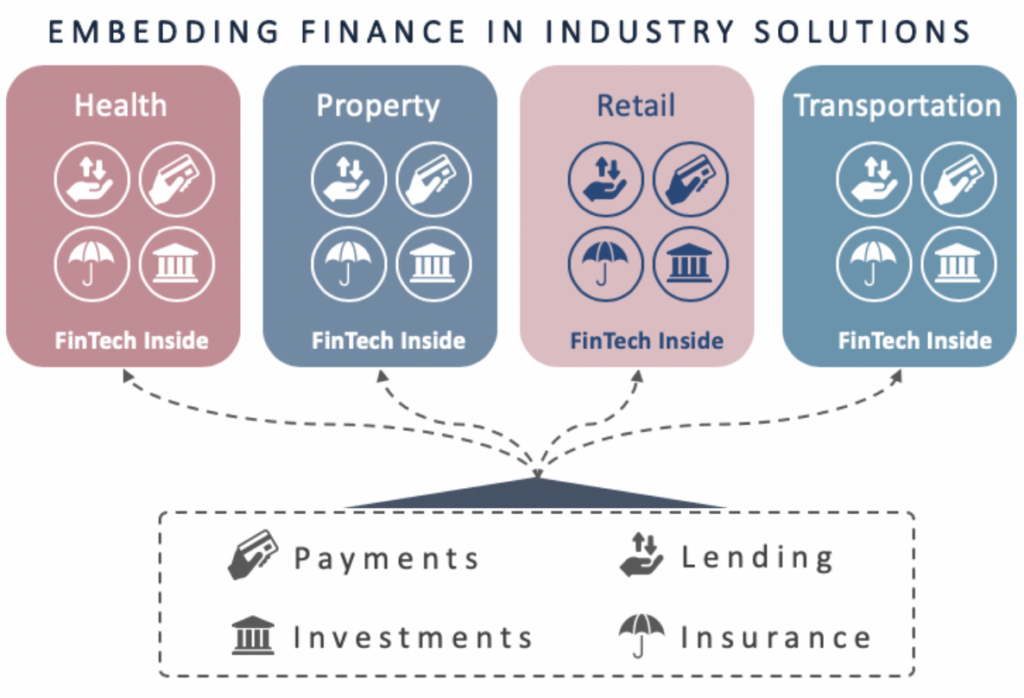

Embedded finance refers to integrating financial products and services into non-financial platforms or businesses, allowing them to offer financial services seamlessly as part of their core offerings. This concept is gaining traction as technology advances and customer preferences evolve. In a credit union context, embedded finance could involve partnering with other businesses or platforms to provide financial services directly to their customers or members. For a credit union, embedded finance might involve:

- Partnerships with eCommerce Platforms: A credit union could partner with an e-commerce platform to offer financing options to customers at the point of sale. This could include providing loans, credit lines, or other financial products during checkout. Think of partnerships with companies like cosmetic surgery centers, Dentists, etc.

- Integration with FinTech Apps: A credit union might integrate its services with popular fintech apps, allowing users to access their credit union accounts, make transfers, or apply for loans without leaving the app.

- Real Estate and Home Buying Platforms: Credit unions could collaborate with real estate platforms to offer mortgage pre-approvals or other lending solutions to individuals looking to buy homes. Consider real estate offices or online real estate companies.

- Peer-to-Peer Payment Apps: Integration with peer-to-peer payment apps could allow credit union members to send money, split bills, and make payments directly from these apps. Venmo, Zelle, PayPal, and EWallets are options to consider.

- Small Business Services: A credit union could embed its business banking and lending services into platforms catering to small businesses, enabling them to access financial solutions for their operations easily; Square, Stripe, or merchant services companies may be candidates.

- Ride-Sharing or Gig Economy Apps: For credit unions, collaborating with gig economy platforms could provide financial tools tailored to gig workers, such as instant payment options or access to short-term loans; Lyft and Uber are possibilities.

- Education and Financial Wellness Platforms: Integration with educational platforms could allow credit unions to provide financial literacy content, budgeting tools, and other resources to help individuals make informed financial decisions.

- Personal Finance Management Apps: Credit unions could integrate their services with apps designed to help users manage their personal finances, offering insights into spending, saving, and investment options. MX has a very robust PFM application.

- Healthcare and Insurance: In collaboration with healthcare or insurance platforms, credit unions could offer health savings accounts (HSAs), insurance products, or other healthcare-related financial services.

Embedded finance allows credit unions to expand their reach and offer services through various digital channels, enhancing convenience and meeting customers’ needs in new and innovative ways. It’s about providing financial services where and when customers need them most rather than confining those services to traditional banking channels.