Senior Leadership

Twelve Steps to Bonding with Your Members

Unlike traditional banks, credit unions have a mission to serve their members, not shareholders. This fundamental difference makes building solid and lasting relationships with their members possible. To make members love their credit union, focusing on delivering exceptional service, fostering trust, and offering financial products that meet their needs is essential. Below, I will explore…

Read MoreShould YOU Consider a Fractional Executive?

To thrive in today’s ever-evolving financial landscape, credit unions must adapt, innovate, and strategically manage their operations. One innovative solution that credit unions are increasingly turning to is the fractional executive. Fractional executives are experienced professionals who work, typically as contract employees, part-time or on a project basis, to provide specialized expertise and leadership. In…

Read MoreDiscovering Your Niche

How Credit Unions Can Identify and Serve Unique Markets Credit unions are known for their community-based approach and member-centric services. While larger banks are designed to cater to a broad spectrum of customers, “being all things to all people,” credit unions can have a distinct advantage by serving specific niche markets that require customized products…

Read MoreFive Lessons in Resilience 9/11 Taught Us

Most of us remember the horror of watching two planes fly into the World Trade Center towers. I remember watching the second plane fly into the south tower. It was like watching a movie, but it was real and terrifying. Even after 20 years, I still feel a deep sorrow when I reflect on this…

Read MoreMake your strategic planning process INCLUSIVE

Strategic planning is an essential part of any organization’s success. It helps businesses to define their goals, set priorities, and allocate resources effectively. In today’s diverse and rapidly evolving work environment, it’s more important than ever to prioritize inclusivity in all aspects of business planning, especially strategic planning. Being more inclusive in strategic planning will…

Read MoreJunk Fees- Credit Unions have options

Junk Fees are making the headlines. Many of these “junk fees” are designed to punish a member for bad behavior. Is this what the mission, “People helping People,” means? Using fees to punish members who have made mistakes, are financially stressed, or are struggling doesn’t fit this mission. This article will clarify what they are…

Read MoreYou Got that Job. Now Stay Humble!

Maybe you’ve observed this situation. Someone gets promoted to a role they have aspired to attain for years. Almost instantly, their communication takes on a new tone, and maybe arrogance creeps into their behaviors. Several years ago, I read an article about someone who had taken over my previous job. In the article, my successor…

Read MoreA Culture of Accountability, the Pathway to Strategic Success

Building a culture of accountability within a credit union is crucial for fostering transparency, responsibility, and overall success. Here are some steps and strategies to help you establish and nurture a culture of accountability: Building a culture of accountability takes time and consistent effort. It’s a collective journey that involves everyone in the credit union…

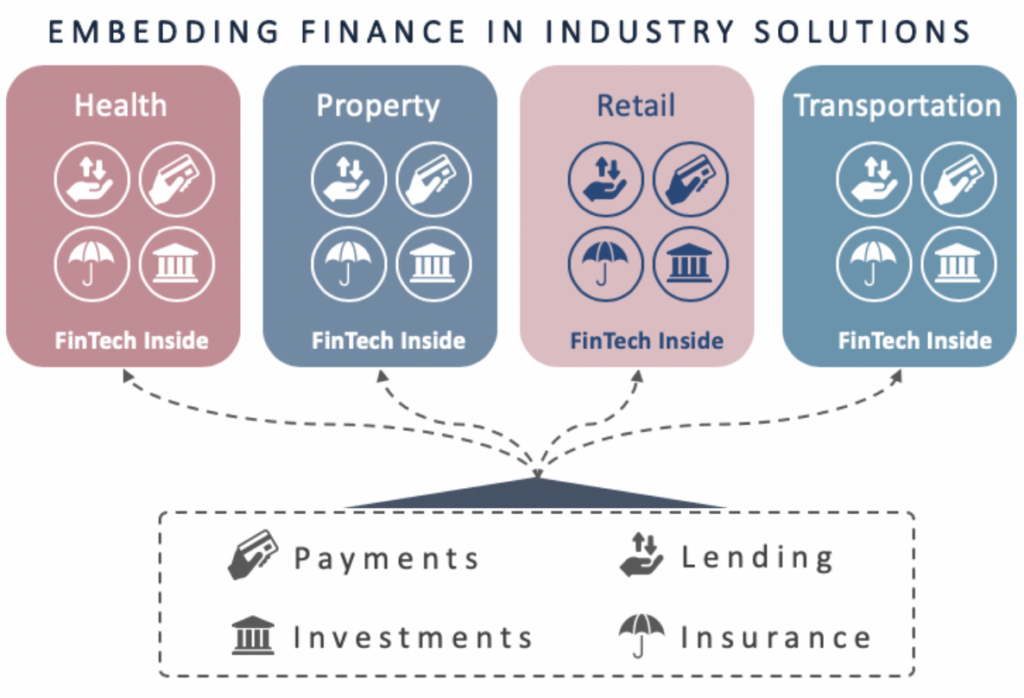

Read MoreEmbedded Finance

Taking banking to where your members live their lives. Embedded finance refers to integrating financial products and services into non-financial platforms or businesses, allowing them to offer financial services seamlessly as part of their core offerings. This concept is gaining traction as technology advances and customer preferences evolve. In a credit union context, embedded finance…

Read More