Business Development

Discovering Your Niche

How Credit Unions Can Identify and Serve Unique Markets Credit unions are known for their community-based approach and member-centric services. While larger banks are designed to cater to a broad spectrum of customers, “being all things to all people,” credit unions can have a distinct advantage by serving specific niche markets that require customized products…

Read MoreEmbedded Finance

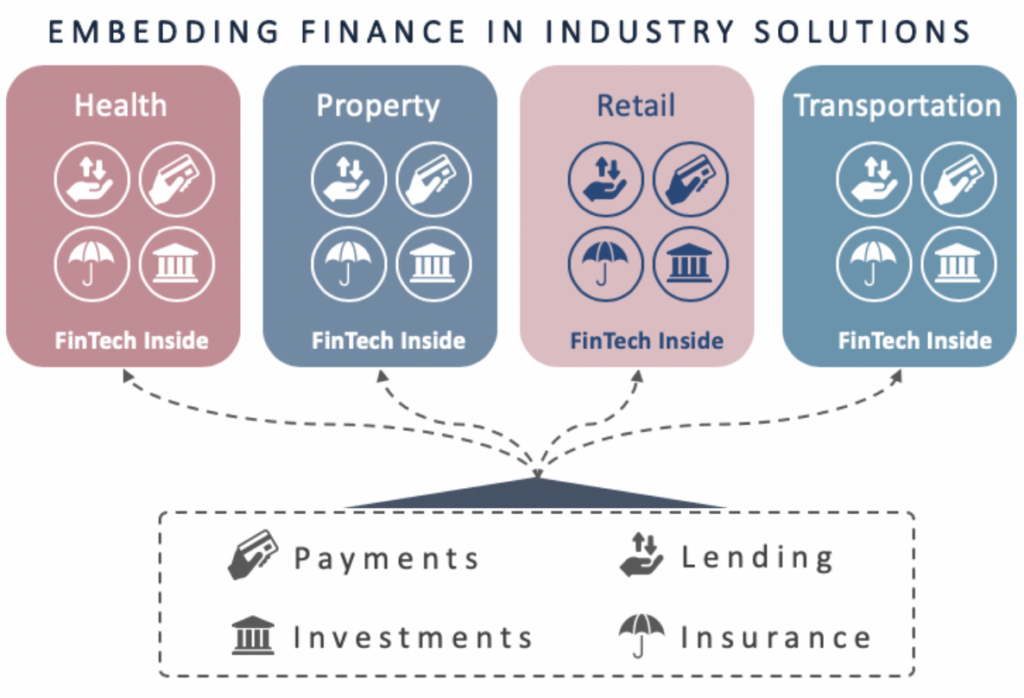

Taking banking to where your members live their lives. Embedded finance refers to integrating financial products and services into non-financial platforms or businesses, allowing them to offer financial services seamlessly as part of their core offerings. This concept is gaining traction as technology advances and customer preferences evolve. In a credit union context, embedded finance…

Read MoreIndirect Auto Lending? Pros and Cons.

Indirect auto lending, where a credit union partners with car dealerships or a direct lending CUSO to offer financing to their customers, has become a popular method of expanding loan portfolios and attracting new members. However, like any financial service, there are both benefits and drawbacks associated with this approach. This article will explore the…

Read MoreGap Funding – Bridging the Divide and Driving Economic Empowerment

In pursuing a more equitable society, supporting businesses owned by individuals from marginalized communities is paramount to a vital, innovative, and sustainable economy. These marginalized groups include BIPOC (Black, Indigenous, and People of Color), women, veterans, and rural entrepreneurs. These entrepreneurs face unique challenges, the least of which is limited access to capital. Mentoring, coaching,…

Read MoreBuilding a purpose-driven team in 7 steps

Building an extraordinary team is essential for any organization to succeed. However, creating a high-performing team is a complex task, requiring a lot of effort, patience, and commitment from both the team leader and the team members. This article will discuss the steps necessary to build an extraordinary team. Building an extraordinary team requires effort,…

Read MoreImprove your leadership presence!

Leadership presence is a vital aspect of being an effective leader. It refers to how you carry yourself, communicate, and interact with others. Your leadership presence can inspire and motivate people to follow you or create a sense of unease and reluctance. To improve your leadership presence, here are some tips that can help. Changing…

Read MoreThe Rainmaker in Business Development

“We have 537 Select Employer Groups.” Pick a number, but how often have we heard this boast? It can be the boast by a multi-common bond or a community field of membership credit union. Is this model of adding hundreds of small businesses into our membership prospects creating anything other than incremental growth of members…

Read MoreThree Strategies to Grow Deposits and Liquidity

“The times, they are a-changin’.” This famous refrain from Bob Dylan’s song (https://www.youtube.com/watch?v=e7qQ6_RV4VQ) is as accurate today as in the early 60s, especially when we look at deposit needs for financial institutions. In 2008, FIs had to shrink deposits to keep their capital ratio in line with the regulators. Marketers became accustomed to focusing almost…

Read MoreData-Driven Marketing – A Primer

For marketers today, it was essential to bring to light how the Marketing team will provide offers to members as it’s a significant change to our traditional methodology. The new approach is designed to provide improved, more consistent and more relevant product offers using the wealth of data from our core and your ancillary systems…

Read More