Posts Tagged ‘sales’

Financial Literacy vs Financial Wellness – a Consumer’s View

Credit unions and banks across the country have financial literacy on their to-do list, but what consumers need/want is a roadmap to financial wellness, not just financial literacy. Well, what’s the difference? Financial literacy is about understanding money basics. Typically the curriculum includes topics like “how to balance your checkbook,” “what is a savings account,”…

Read MoreThe Rainmaker in Business Development

“We have 537 Select Employer Groups.” Pick a number, but how often have we heard this boast? It can be the boast by a multi-common bond or a community field of membership credit union. Is this model of adding hundreds of small businesses into our membership prospects creating anything other than incremental growth of members…

Read MorePay for Performance and Reputation Risk

An increasing trend in the financial services sector is “pay for performance.” This practice shows up in several formats: Commission – rep is paid a percentage of balances acquired Incentive – rep is paid per closed referral Bonus – rep is paid based on goal performance over a set period (per month, quarter, bi-annually, annually)…

Read More3X3 Essentials for Business Development

Business Development success is essential regardless of your credit union’s field of membership. BD success requires focusing on three critical measures: growing members, assets, and balances; the first 3 of the 3X3. Generating sustainable growth of members and assets is the key to a credit union’s survival. Even if one of your credit union’s key…

Read MoreMarketing Must Know These Key Ratios

The primary Business Model for credit unions is straightforward. It is Money in Money out. Credit unions buy money ( deposits) from members (Cost of Funds) and then loans out those deposits to Members (Interest Income) at a higher interest rate (Margin). Of course, there are multitudes of nuance to this model, that’s why credit…

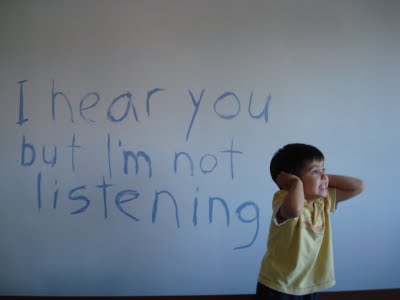

Read MoreLeaders Don’t Listen? Really?

Condoleezza Rice once said, “When you’re in a position of authority, you need truth-tellers around you.” Did she hit the mark? You bet.First, let us agree that one element of leadership is the authority. To be a leader, you must have some authority. This authority isn’t determined by power but by your ability to motivate,…

Read MoreBranching Strategy, It Starts with the Member

Historically branches are seen as transaction channels. Today, this view of branches has changed and continues to evolve. Members and potential members like the convenience of brick and mortar, they like the demonstration of financial strength and security. Still, the truth is, they rely less on branches for their daily, weekly, and monthly transaction business…

Read MoreQuiet, Is it Selfish or Scared?

When leading a team and a decision is needed, what happens? Is it silence or negotiation and debate? Let’s assume that you have assembled the right people for the team; you have the subject-matter experts to be able to make the right decisions. But just having the right experts at the table does not guarantee…

Read MoreYou have to be an Executive to be a Leader – NOT!

A collective leadership misperception is that it happens to you as a result of a promotion. Sadly, many executives foster this climate of “ordained leadership” by acting as though they, as executives, are smarter than the masses and are therefore more worthy of making a decision. This culture stifles individual contribution, engagement, job satisfaction, and…

Read More