Strategic Planning

Is Your Org Structure Top-Heavy?

First, let’s understand the impact of a top-heavy organizational structure on a credit union’s effectiveness, efficiency, and overall performance, which is critical. Here are the risks a top-heavy organization poses: Addressing a top-heavy organizational structure can be a significant challenge for a new CEO. Still, there are several practical steps to streamlining the organization and creating…

Read MoreThe Friction Paradox – Compliance vs User Experience

Friction /?frikSH?n/ noun – Any unnecessary obstacles users encounter while interacting with banking products or services. These manifest in various forms, including cumbersome account opening procedures, complex loan applications, processes that are not aligned or consistent from channel to channel, or outdated digital interfaces. While some friction is essential for security and regulatory compliance, excessive…

Read MoreIs Your Org Structure Shackling Strategic Success?

Credit unions need to see their organizational structure as an organism, NOT a hierarchy. Innovation and adaptability reign supreme in credit unions. Being locked into a legacy organizational structure in a cross-functional, cross-silo operating environment often stifles short and long-term success. While these structures may have served the credit union well in the past, they…

Read MoreYou Are a New Executive in a Credit Union, Onboard Yourself First!

Joining a credit union as a CEO, EVP, SVP, or VP is exciting yet challenging. As an executive leader, your role is pivotal in driving the credit union’s strategies, mission, vision, values, growth, and member satisfaction. It is rare to find a credit union with a disciplined process to onboard executives, which, by the nature…

Read MoreFeeling Pressure for a Hasty Executive Hiring Decision?

Recently, I have observed several credit unions make hiring mistakes for key executives, including CEOs. The disruption these “hasty hires” cause is palatable. In one situation, a CEO who lacked the strategic mindset the credit union needed was hired. In another, there was a significant skill gap; they hired a “finance person” when they needed…

Read MoreStriking the Right Balance Between Staffing Needs and Wants

In the not-too-distant past, we saw quiet quitting, and it appears in 2024 that we are seeing a return to layoffs. For example, Kinecta Credit Union, with 806 full-time equivalent employees, recently laid off 84 employees due to a fall in earnings. And, Kinecta is not alone in this trend. The workplace looks and feels…

Read MoreCredit Unions Embracing the Future

The Transition to Web3 and Distributed Ledger Technology A new technology solution no only holds the potential for all credit unions but promises to level the playing field for smaller credit unions. This disruptive technology affordably transforms a credit union, allowing it to offer decentralized and transparent systems that promise to democratize financial services. Web3…

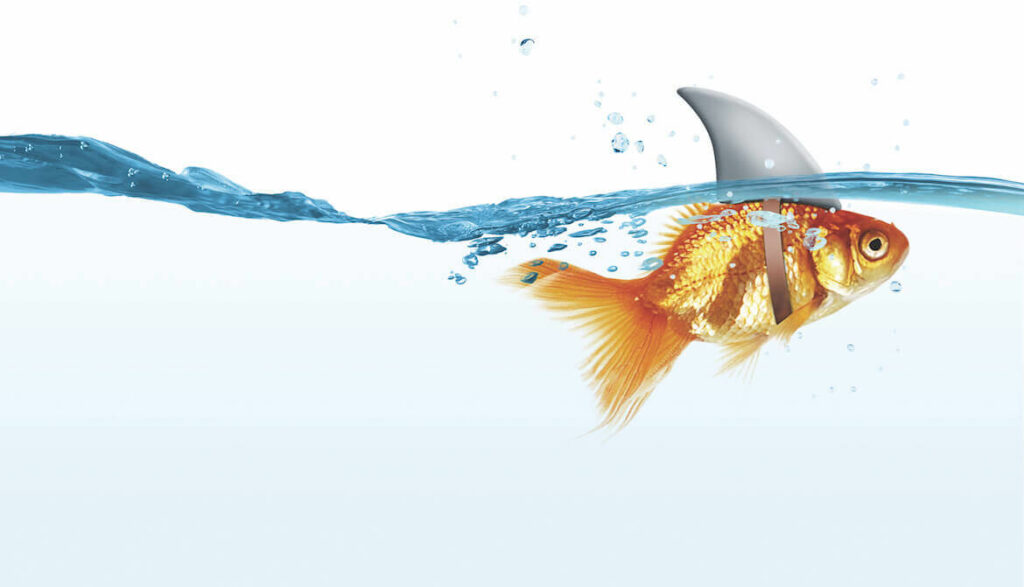

Read MoreHow Small Credit Unions Can Become Vital

For the past 20+ years, credit unions seeking to grow, have made charter changes to community charters, often from multi-common bond or sole sponsorship charters. The goal was to minimize the perceived barriers to membership. The belief was that if anyone could join my credit union, growth would be unconstrained. In some cases, this was…

Read MoreFive Steps to Creating a Digital Culture

When asked “In the past year, which method did you use most often to manage your bank account(s)?” consumers responded as follows: Mobile (apps on smartphone or tablet) – 45% Internet/Online (Laptop or PC) – 27% Branches – 14% (Oct 31, 2022 – American Bankers Association) This statistic says a lot! Mobile utilization is the preferred method…

Read More