IT Integrations

Preparing Your Culture Ready for Data Analytics

When most of us think about data, we think about numbers, charts, graphs, and reports. However, we need to talk about CULTURE. Collecting, aggregating, normalizing, manipulating, and presenting data seems to consume the conversation. However, here is the question we need to ask ourselves, “Is our culture ready to become truly data-driven?” Too often organizations…

Read MoreYour Digital Strategy is Probably Wrong

Competing in the digital space is getting more difficult and more and more essential to the credit union’s sustainability. Chances are, your current digital strategy is missing these five things. Organizational Alignment – most credit unions have all their data in silos. IT is doing one thing, marketing another, branches another, call center another, remote…

Read MoreCMOs Need to Measure and Analyze the Data!

The CMO is faced with a constant challenge to prove the value of their marketing efforts. The channels we use continue to grow, the technology continues to innovate, and the consumer expects more personalization and customization of offers than ever before. To be successful, CMOs must collect, segment, analyze and visualize the data to create…

Read More6 Steps to Transforming Your Credit Union for the Digital Economy

The digital economy is a new world order where their digital profiles and personas are directing consumer behaviors and buying decisions. The digital economy will lead them to products and services, special offers, activities, and events based upon recommended by these profiles and personas. It’s not a matter of if or even when it is…

Read MoreCore Integrations Like Solving Cancer?

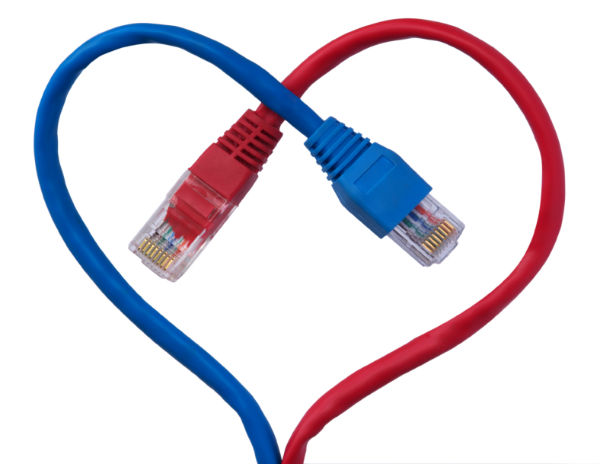

Although this may seem like an exaggeration, it is extremely hard and costly for a vendor to connect to the core provider. Credit unions are also frustrated by these challenges because they prevent or at best slow down the credit union’s ability to provide their members the best products, services or applications. This slowing down…

Read MoreNegotiate for Cheaper/Faster Core Integrations

The efficiencies and speed to market are realized when credit unions, core providers and vendors agree to a standard for integrations. Most credit unions have their focus on expense control and organizational efficiencies. Also vendors and core providers know any operating efficiencies credit unions realize will result in more sales and faster implementations of products…

Read MoreIntegrations Standard – The Time Has Come

Fifty-four third party integrations to core; what does this number mean? This number represents: 54 separate IT projects that include hours upon hours of IT resources 54 separate contacts for professional services and the related costs 54 different technologies that may have to be updated or tested with every core or system update 54 times…

Read More$MM Wasted on IT Integrations!!!

Its no secret, credit unions are spending millions of dollars every year integrating technologies. These integrations happen vendor to core and vendor to vendor. It seems an unavoidable cost of doing business. But is it? The CUNA Technology Council launched a cooperative initiative with council members and credit union vendors to solve this expensive problem.…

Read MoreSystem Integrations the COO will Love

COOs are continually seeking these four things: Improved member service Improved processes Improved efficiency Engaged staff To accomplish these goals they require new software, tools, applications, employee interfaces and a continual stream of real-time member information and channel reporting. These tools and applications typically require integration into core or vendor to vendor. Here is what…

Read More