IT Integrations

Open Banking – Securing Member Data

Part 5 CUToday’s June 26 newsletter: Truliant FCU Faces Proposed Class Action Lawsuit Over Data Breach: WINSTON-SALEM, N.C.–Truliant Federal Credit Union faces a proposed class action lawsuit after a data breach reportedly exposed the private information of more than 48,000 members… CUToday’s July 2 newsletter: ‘Serious Security Incident’ Leads to Major System Outage at Patelco…

Read MoreA Future for Small Credit Unions

Part 4 – How Open Banking and Distributed Ledger Technology will help small credit unions compete. Open Banking and Distributed Ledger Technology (DLT) offer several advantages that can help smaller credit unions compete more effectively with larger financial institutions. Here’s how these technologies will be beneficial: Open Banking Benefits Distributed Ledger Technology (DLT) Benefits Combined…

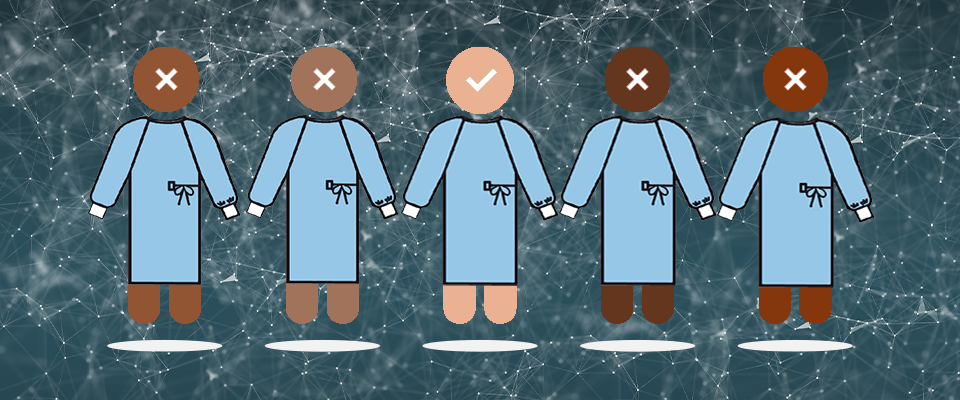

Read MoreData Governance – Mitigating Data Biases

Part 3 Credit unions have many data sources beyond their core operating system. When a credit union conducts a data source inventory, it is not uncommon to have 50 or more data sources. These third-party data sets and reports commonly come in various formats, with different labels and definitions, and upload and report timing. Inconsistency…

Read MoreMitigating the Risks of Open Banking

Part 2 Navy Federal Credit Union (NFCU) recently faced a lawsuit centered on using artificial intelligence (AI) in its customer service operations. The lawsuit highlighted several critical issues, including data privacy, algorithmic bias, and transparency. This incident underscores the broader risks associated with adopting advanced technologies, such as AI, within the framework of open banking.…

Read MoreProducts and Services Likely to be Disrupted by Open Banking and DLT

Part One A headline in CUToday’s June 11 newsletter: “Headed to the U.S.? Stripe Intro’s Open-Banking-Powered Payments in the U.K.” This is one example of how Open Banking will revolutionize (disrupt) the financial services industry. Credit unions are not exempt from this disruptive wave. What is Open Banking? #Open Banking is a financial services innovation that…

Read MoreThe Friction Paradox – Compliance vs User Experience

Friction /?frikSH?n/ noun – Any unnecessary obstacles users encounter while interacting with banking products or services. These manifest in various forms, including cumbersome account opening procedures, complex loan applications, processes that are not aligned or consistent from channel to channel, or outdated digital interfaces. While some friction is essential for security and regulatory compliance, excessive…

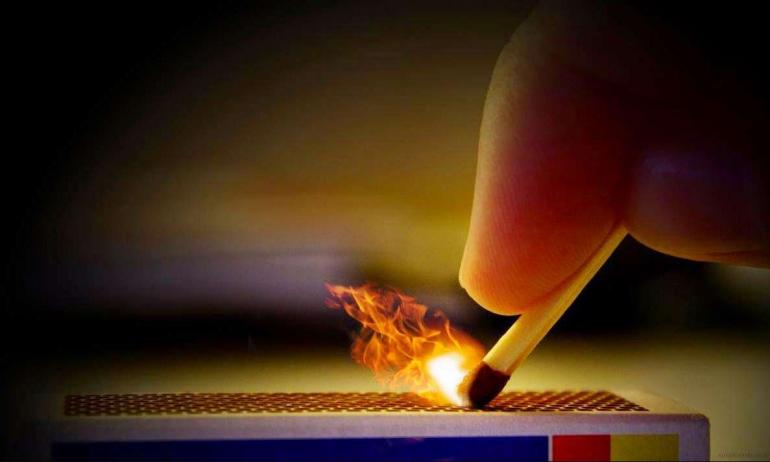

Read MoreRemote Backup System – A Way to Thwart a Ransomware Attack

Over 60 credit unions have suffered ransomware attacks in the past few months. Having a remote backup system plays a significant role in thwarting your credit union from becoming a ransomware attack victim. What is Ransomware? Ransomware is malware that encrypts files on a victim’s system, rendering them inaccessible until a ransom is paid. With…

Read MoreCredit Unions Embracing the Future

The Transition to Web3 and Distributed Ledger Technology A new technology solution no only holds the potential for all credit unions but promises to level the playing field for smaller credit unions. This disruptive technology affordably transforms a credit union, allowing it to offer decentralized and transparent systems that promise to democratize financial services. Web3…

Read MoreA Primer – Distributed Ledger and Web3 Technology for Credit Unions

It is equally accessible and affordable to small and large credit unions We’ve all watched the transformation for banking from an exclusive brick and mortar model to the Web2 model for digital and online banking. Now a new disruptive technology is coming to the forefront. Pioneered by Defy FCU and Bank Social (https://www.disruptionbanking.com/2023/11/16/banksocial-announces-proposed-defy-federal-credit-union-at-north-american-blockchain-summit/), Web3 (https://web3.foundation/)…

Read More